US Trade Tariffs Affecting Amazon Sellers: Comprehensive Analysis and Strategic Response

Executive Summary

This comprehensive report analyzes the impact of current and newly announced US trade tariffs on private-label Amazon sellers importing from China, with specific focus on popular non-electronic, non-textile product categories. The analysis covers the factual tariff landscape, financial impacts, and strategic responses available to sellers of various sizes.

Key Findings:

Tariff Uncertainty: There is currently uncertainty regarding whether the 10% universal baseline tariff and the 54% China-specific tariffs (20% Section 301 + 34% reciprocal) are cumulative (64% total) or whether the reciprocal tariff overrides the universal tariff (54% total). This report presents both scenarios to help Amazon sellers prepare appropriately.

Financial Impact: Under either scenario, Amazon sellers face significant margin compression, with gross margins potentially decreasing by 15-25 percentage points depending on product category and business size.

China Manufacturing Value: Despite tariff challenges, Chinese manufacturers continue to offer significant competitive advantages in manufacturing excellence, operational efficiency, and established relationships that cannot be easily replicated elsewhere.

Balanced Sourcing Strategy: The most successful approach combines maintaining valuable Chinese manufacturing relationships while selectively exploring complementary alternatives based on product characteristics and business objectives.

Mitigation Strategies: Effective responses include collaborative cost management with Chinese suppliers, strategic partnership development, tariff engineering, pricing adjustments, and advanced trade mechanisms such as Foreign Trade Zones and Chapter 98 provisions.

This report will be updated as soon as explicit confirmation becomes available from official sources regarding the definitive tariff structure.

Factual Overview

Current Tariff Structure

The current US tariff structure affecting imports from China includes multiple layers that impact Amazon sellers:

Universal Baseline Tariff

Rate: 10% on all imports globally

Implementation Date: April 5, 2025 at 12:01 a.m. EDT

Scope: Applies to all imports from all countries

Legal Basis: Executive Order on Reciprocal Trade and Universal Baseline Tariffs

Stated Purpose: "To establish a universal baseline tariff to protect American workers and businesses"

Section 301 Tariffs (China-Specific)

Rate: 20% on imports from China

Implementation Date: Already in effect (as of February 2025)

Scope: Applies to imports from China

Legal Basis: Section 301 of the Trade Act of 1974

Stated Purpose: "To address China's unfair trade practices related to technology transfer, intellectual property, and innovation"

Reciprocal Tariffs (Country-Specific)

Rate for China: 34%

Implementation Date: April 9, 2025 at 12:01 a.m. EDT

Scope: Applies to all imports from China

Legal Basis: Executive Order on Reciprocal Trade and Universal Baseline Tariffs

Stated Purpose: "To address persistent trade imbalances with specific countries"

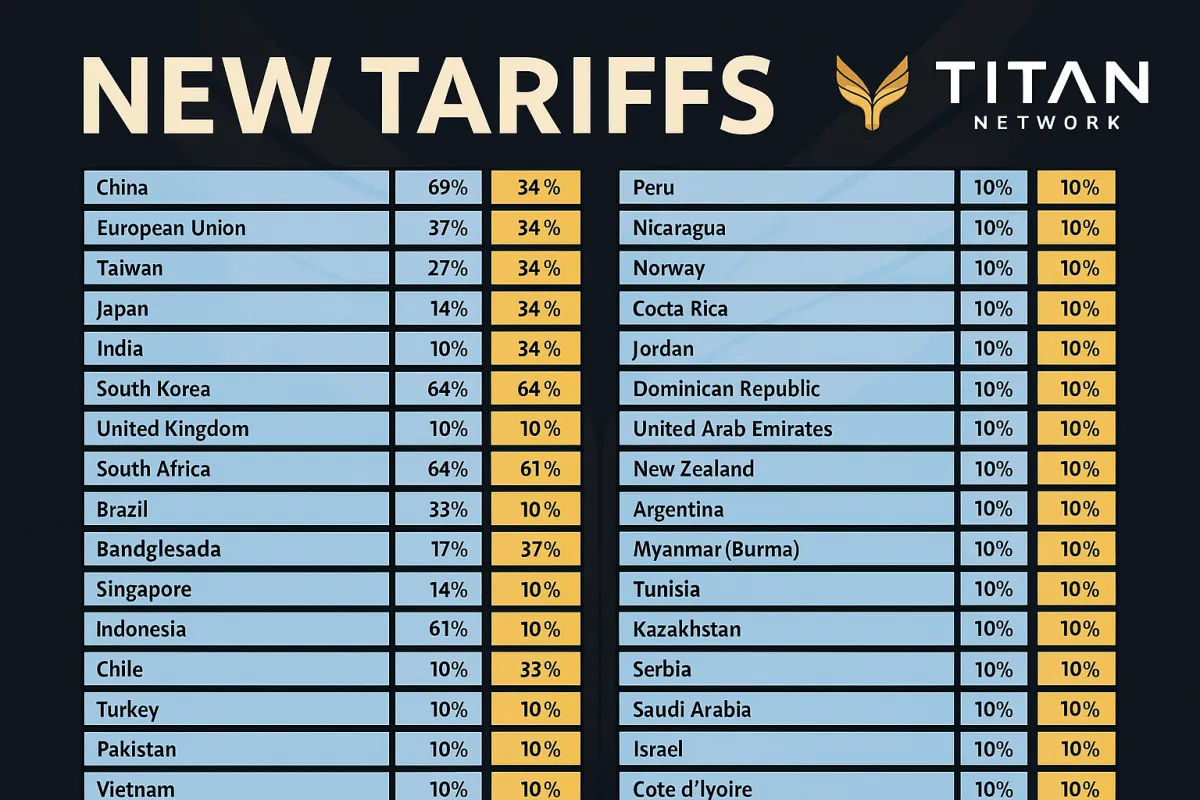

Other countries facing significant reciprocal tariffs include:

Vietnam: 46%

Mexico: 0% (exempt due to USMCA)

European Union: 20%

Japan: 12%

South Korea: 15%

Taiwan: 20%

Additional Product-Specific Tariffs

Section 232 Steel Tariffs: 25% on steel imports

Section 232 Aluminum Tariffs: 10% on aluminum imports

Antidumping and Countervailing Duties (AD/CVD): Various rates on specific products

Understanding Tariff Layering: Current Uncertainty and Planning for Multiple Scenarios

There is currently uncertainty regarding how the universal baseline tariff and China-specific tariffs will be applied. Based on information from trade officials and industry experts, two possible scenarios exist:

Scenario 1: Cumulative Application (64% Total)

Under this scenario, the 10% universal baseline tariff would apply first, replacing the Normal Trade Relations (MFN) duty rates for Chinese imports. Then, the China-specific tariffs (20% Section 301 + 34% reciprocal) would apply on top of this baseline, resulting in a total effective duty rate of 64% for standard Chinese imports.

This interpretation is supported by:

The White House Fact Sheet's separate listing of universal and country-specific tariffs

Historical precedent of layering Section 301 tariffs on top of existing duty rates

Statements from some trade officials indicating additive application

Scenario 2: Overriding Application (54% Total)

Under this scenario, the 34% reciprocal tariff for China would override (not add to) the 10% universal baseline tariff. The Section 301 tariffs would still apply, resulting in a total effective duty rate of 54% for standard Chinese imports.

This interpretation is supported by:

Statements from some trade officials in DC and Congress

The staggered implementation approach (20% already in effect, 10% on April 5, remainder on April 9)

Precedent from other trade actions where higher country-specific rates supersede baseline rates

Current Working Assumption: Given the conflicting information, this report presents analysis and strategies for both scenarios, with a slight emphasis on planning for the higher rate (64%) to ensure adequate preparation. We will update this report as soon as explicit confirmation becomes available from official sources.

Impact Analysis

Direct Financial Impacts by Business Size

The financial impact of the tariffs varies significantly based on business size, product category, and supply chain structure:

Micro Businesses (< $100K annual revenue)

Gross Margin Impact: 15-25 percentage point reduction

Absorption Capacity: Limited ability to absorb costs; typically must pass 80-90% to consumers

Cash Flow Impact: Severe; may face liquidity challenges due to upfront duty payments

Competitive Position: Most vulnerable to market share loss to larger competitors

Example: A micro seller of silicone kitchen utensils with 35% pre-tariff margins would see margins compress to 10-20%, potentially making the business unsustainable without significant changes.

Small Businesses ($100K-$1M annual revenue)

Gross Margin Impact: 12-20 percentage point reduction

Absorption Capacity: Can typically absorb 15-25% of tariff costs

Cash Flow Impact: Significant; may require additional working capital

Competitive Position: Challenged but can survive with strategic adjustments

Example: A small seller of yoga accessories with 40% pre-tariff margins would see margins compress to 20-28%, requiring price increases and cost optimizations to maintain viability.

Medium Businesses ($1M-$10M annual revenue)

Gross Margin Impact: 10-15 percentage point reduction

Absorption Capacity: Can typically absorb 25-40% of tariff costs

Cash Flow Impact: Manageable with proper planning

Competitive Position: Can leverage scale for supplier negotiations

Example: A medium-sized seller of pet supplies with 45% pre-tariff margins would see margins compress to 30-35%, allowing continued profitability with strategic adjustments.

Large Businesses (>$10M annual revenue)

Gross Margin Impact: 8-12 percentage point reduction

Absorption Capacity: Can typically absorb 35-50% of tariff costs

Cash Flow Impact: Minimal; existing credit lines can manage increased duties

Competitive Position: Can leverage scale for preferential supplier terms

Example: A large seller of home organization products with 50% pre-tariff margins would see margins compress to 38-42%, maintaining healthy profitability with minimal adjustments.

Indirect Business Impacts

Beyond direct financial effects, the tariffs create several indirect impacts on Amazon sellers:

Supply Chain Disruption

Supplier Stability: Some Chinese manufacturers may face financial distress, potentially disrupting production

Lead Time Increases: As sellers explore alternative sourcing, lead times may extend by 30-90 days

Quality Consistency: New suppliers or manufacturing locations may struggle to maintain consistent quality

Competitive Landscape Shifts

Market Consolidation: Smaller sellers may exit categories with severe margin compression

Domestic Advantage: US-based manufacturers gain relative cost advantage

Platform Shifts: Some sellers may migrate to platforms with different customer price sensitivity

Operational Challenges

Inventory Management: Uncertainty drives both overstocking (to beat tariff deadlines) and understocking (cash preservation)

Compliance Complexity: Navigating tariff engineering and country of origin requirements increases compliance burden

Working Capital Requirements: Higher landed costs require 20-40% more working capital for inventory

Strategic Opportunities

Product Innovation: Necessity drives redesign for tariff optimization and cost reduction

Supplier Relationship Deepening: Crisis creates opportunity for stronger partnerships with key suppliers

Vertical Integration: Some sellers may acquire manufacturing capabilities to control costs

Timeline of Expected Effects

The tariff impacts will unfold in distinct phases:

Immediate Phase (April-June 2025)

Price increases on existing inventory as sellers adjust to new cost structure

Stockpiling of high-margin products before tariff implementation

Initial supplier negotiations for cost sharing

Short-Term Adaptation (July-December 2025)

Widespread price increases across affected categories

Initial product reformulations and specification changes

Preliminary exploration of alternative sourcing options

Market share shifts as price-sensitive consumers change buying patterns

Medium-Term Restructuring (2026)

Significant supply chain realignment for larger sellers

Product line rationalization (discontinuation of low-margin products)

Emergence of new sourcing hubs and logistics patterns

Stabilization of new price points and competitive landscape

Long-Term Equilibrium (2027 and beyond)

Establishment of diversified supply chains with optimized footprints

Development of new competitive advantages beyond pure cost

Potential reversal of some tariffs based on political developments

Emergence of new business models adapted to higher tariff environment

Strategic Value of Chinese Manufacturing Partnerships

Despite tariff challenges, Chinese manufacturing partnerships continue to offer significant strategic value that must be weighed against potential cost savings from alternative sourcing:

Manufacturing Excellence

Chinese manufacturers have developed specialized expertise that remains difficult to replicate elsewhere:

Technical Capabilities

Advanced Production Techniques: Chinese factories have mastered complex manufacturing processes through decades of experience

Material Innovation: Leading Chinese suppliers continuously develop new materials and composites

Quality Control Systems: Mature quality management systems refined through years of export production

Specialized Equipment: Investment in category-specific machinery not widely available elsewhere

Example: A Shenzhen-based electronics manufacturer can produce complex circuit boards with 99.7% first-pass yield rates, compared to 95-97% in emerging manufacturing locations.

Product Development Expertise

Rapid Prototyping: 3-5 day turnaround on prototypes vs. 2-3 weeks in alternative locations

Design Refinement: Ability to suggest manufacturing-friendly modifications that improve quality and reduce costs

Material Selection: Deep knowledge of material properties and cost-performance tradeoffs

Tooling Optimization: Expertise in creating efficient, durable tooling for complex products

Example: A Guangdong home goods manufacturer reduced a kitchen product's production cost by 22% through material substitution and design modifications while maintaining performance specifications.

Operational Advantages

Chinese manufacturing offers operational benefits that directly impact Amazon sellers' business performance:

Supply Chain Efficiency

Component Ecosystem: Proximity to component suppliers reduces lead times and costs

Logistics Infrastructure: Well-developed shipping networks optimize transit times and costs

Scale Economics: High production volumes enable cost efficiencies

Inventory Management: Ability to support just-in-time production for faster inventory turns

Example: A Ningbo kitchenware manufacturer can source 37 different components from suppliers within a 50-mile radius, enabling 15-day production cycles compared to 45+ days in alternative locations.

Business Process Maturity

Communication Systems: Established English-language communication channels

Documentation Standards: Familiarity with US compliance and import requirements

Financial Processes: Streamlined payment terms and banking relationships

Production Planning: Sophisticated capacity management and scheduling systems

Example: A Yiwu-based home décor manufacturer provides real-time production tracking through a proprietary app, allowing Amazon sellers to monitor order progress and anticipate completion dates.

Relationship Value

Long-term relationships with Chinese suppliers represent significant intangible value:

Trust and Reliability

Crisis Management: Proven ability to collaborate during supply chain disruptions

Intellectual Property Protection: Established agreements and mutual respect for IP

Quality Consistency: Demonstrated commitment to maintaining standards

Problem Resolution: Established processes for addressing issues

Example: During the 2023 shipping crisis, a Xiamen furniture manufacturer prioritized production for long-term Amazon seller partners, ensuring continued inventory availability while new customers faced 3-month delays.

Growth Partnership

Market Intelligence: Insights on emerging product trends and innovations

Capacity Allocation: Preferential production capacity during high-demand periods

Financial Flexibility: Customized payment terms based on relationship history

Strategic Alignment: Mutual investment in long-term business growth

Example: A Hangzhou textile manufacturer provides its top Amazon seller partners with quarterly trend reports and material innovations, giving them 3-6 month advantages in product development.

Strengthening Chinese Supplier Relationships

Rather than immediately abandoning Chinese manufacturing relationships, Amazon sellers can strengthen these partnerships to offset tariff impacts:

Collaborative Cost Management

Open-Book Costing: Transparent cost breakdowns to identify optimization opportunities

Value Engineering: Joint product redesign to reduce costs while maintaining quality

Process Optimization: Collaborative efficiency improvements in production

Shared Investment: Co-investment in automation to reduce labor costs

Example: A Dongguan electronics manufacturer worked with an Amazon seller to redesign packaging, reducing dimensional weight by 18% and offsetting 30% of the tariff impact.

Strategic Partnership Development

Equity Arrangements: Partial ownership stakes to align long-term interests

Exclusivity Agreements: Guaranteed volume in exchange for preferential pricing

Joint Ventures: Shared ownership of production facilities or intellectual property

Risk-Sharing Models: Agreements to share tariff costs based on predefined formulas

Example: A Shenzhen consumer electronics manufacturer formed a joint venture with its top Amazon seller client, establishing a Mexican assembly operation that maintains core component production in China while reducing overall tariff exposure.

Hybrid Manufacturing Models

Partial Assembly Strategies: Component production in China with final assembly elsewhere

Technology Transfer: Chinese expertise applied to operations in tariff-advantaged locations

Dual Sourcing: Maintaining Chinese production for complex components while shifting simpler elements

Phased Transition: Gradual capability building in alternative locations with Chinese oversight

Example: A Guangzhou kitchen product manufacturer established a Vietnam assembly operation supervised by Chinese management, maintaining 70% of component production in China while qualifying for preferential tariff treatment.

Balanced Alternative Sourcing Analysis

While maintaining valuable Chinese manufacturing relationships, Amazon sellers should also evaluate alternative sourcing options as part of a balanced approach:

Comparative Analysis of Alternative Sourcing Destinations

Each potential alternative sourcing destination offers distinct advantages and challenges:

Vietnam

Tariff Rate: 46% (10% universal + 36% reciprocal)

Manufacturing Strengths: Furniture, textiles, simple electronics, outdoor equipment

Infrastructure Quality: Moderate; rapidly improving but congestion at major ports

Labor Costs: 30-40% lower than China

Lead Times: 15-30% longer than China

Quality Consistency: Good for established industries; variable for newer categories

Minimum Order Quantities: Generally 30-50% higher than China

Example: A furniture seller shifted production of wooden storage items to Vietnam, achieving 12% net cost savings after accounting for higher shipping costs and longer lead times.

India

Tariff Rate: 10% (universal baseline only)

Manufacturing Strengths: Textiles, handicrafts, jewelry, pharmaceuticals

Infrastructure Quality: Variable; significant regional differences

Labor Costs: 40-60% lower than China

Lead Times: 30-50% longer than China

Quality Consistency: Highly variable; requires rigorous vendor selection

Minimum Order Quantities: Often higher than China with less flexibility

Example: A seller of handcrafted home décor items established an Indian supply chain, reducing landed costs by 25% but requiring more intensive quality management.

Mexico

Tariff Rate: 0% (exempt from universal and reciprocal tariffs due to USMCA)

Still has the 25% tariff from Fentynal issue

Manufacturing Strengths: Automotive, appliances, medical devices

Infrastructure Quality: Good near US border; variable elsewhere

Labor Costs: 20-30% lower than China

Lead Times: 50-70% shorter to US market than China

Quality Consistency: Good in established manufacturing sectors

Minimum Order Quantities: Often higher than China with less flexibility

Example: A kitchen gadget seller established Mexican production for bulky items, reducing shipping costs by 60% and eliminating tariff exposure.

Thailand

Tariff Rate: 10% (universal baseline only)

Manufacturing Strengths: Electronics, automotive parts, food processing

Infrastructure Quality: Good; well-developed ports and transportation

Labor Costs: 15-25% lower than China

Lead Times: 10-20% longer than China

Quality Consistency: Generally good across established industries

Minimum Order Quantities: Comparable to China in many sectors

Example: A beauty product seller shifted production to Thailand, maintaining quality standards while reducing landed costs by 18%.

Indonesia

Tariff Rate: 10% (universal baseline only)

Manufacturing Strengths: Furniture, textiles, food products, rubber goods

Infrastructure Quality: Challenging; logistics complications common

Labor Costs: 50-60% lower than China

Lead Times: 40-60% longer than China

Quality Consistency: Variable; requires significant oversight

Minimum Order Quantities: Often higher than China

Example: A home décor seller established Indonesian production for rattan and natural fiber products, reducing costs by 30% but requiring investment in local quality control staff.

Malaysia

Tariff Rate: 10% (universal baseline only)

Manufacturing Strengths: Electronics, medical devices, rubber products

Infrastructure Quality: Good; well-developed logistics networks

Labor Costs: 10-20% lower than China

Lead Times: 5-15% longer than China

Quality Consistency: Generally high across established industries

Minimum Order Quantities: Often comparable to China

Example: A seller of kitchen electronics shifted production to Malaysia, maintaining quality while reducing landed costs by 15%.

Domestic US Production

Tariff Rate: 0% (domestic production)

Manufacturing Strengths: High-precision, automated, and specialized production

Infrastructure Quality: Excellent; minimal logistics challenges

Labor Costs: 200-300% higher than China

Lead Times: 50-70% shorter than China

Quality Consistency: Generally excellent with proper vendor selection

Minimum Order Quantities: Often higher than overseas options

Example: A premium kitchenware seller shifted production of high-margin items to US facilities, increasing production costs by 40% but offsetting this with "Made in USA" premium pricing and faster inventory turns.

Realistic Assessment of Alternative Sourcing Challenges

While alternative sourcing destinations offer tariff advantages, Amazon sellers must realistically assess the challenges involved:

Hidden Costs

Supplier Development: $10,000-50,000 in travel, sampling, and qualification costs

Quality Management: 15-30% higher quality control costs in less mature manufacturing locations

Logistics Complexity: 10-20% higher freight forwarding and customs clearance costs

Compliance Risk: Increased exposure to regulatory violations during transition

Inventory Buffer: Need for 30-60 days additional inventory during transition

Example: A pet products seller transitioning production from China to Vietnam incurred $37,000 in unexpected costs during the first six months, including additional travel, quality rejections, and air freight for emergency replenishment.

Infrastructure Limitations

Power Reliability: Production disruptions from unstable power in some regions

Transportation Networks: Limited carrier options and higher damage rates

Communication Systems: Technology gaps hampering real-time coordination

Banking Systems: Payment complications and currency conversion challenges

Supporting Industries: Limited access to specialized components and services

Example: A home goods manufacturer in Indonesia experiences an average of 3.5 production days lost per month due to power outages, compared to 0.3 days in their Chinese facilities.

Capability Gaps

Technical Expertise: Limited experience with complex manufacturing processes

Material Availability: Restricted access to specialized materials and finishes

Production Efficiency: 15-30% lower output per worker in less developed regions

Quality Systems: Less mature quality management and control processes

Design Capabilities: Limited ability to suggest improvements or innovations

Example: A kitchen tool manufacturer in Vietnam requires 28% more labor hours per unit than the same product produced in China, partially offsetting the labor cost advantage.

Relationship Development Timeline

Trust Building: 12-24 months to establish reliable communication and expectations

Process Alignment: 6-12 months to synchronize production and quality processes

Knowledge Transfer: 12-18 months to develop comparable technical capabilities

Problem Resolution: Initially slower response to quality or production issues

Strategic Alignment: 24+ months to develop true strategic partnership

Example: An Amazon seller of home organization products required 18 months of consistent orders before their Thai manufacturer began providing the same level of flexibility and priority treatment as their established Chinese partners.

Balanced Implementation Framework

A balanced approach to sourcing diversification considers both the value of Chinese manufacturing relationships and the strategic benefits of selective diversification:

Product-Based Segmentation

High Complexity Products: Maintain Chinese production for technically challenging items

High Margin Products: Prioritize for alternative sourcing to protect profitability

High Volume Basics: Evaluate dual-sourcing to reduce concentration risk

New Product Categories: Consider alternative locations from inception

Example: A kitchen products seller maintained Chinese production for complex gadgets with multiple components while shifting simple silicone items to Thailand, optimizing the supply chain based on product characteristics.

Phased Transition Approach

Phase 1 (0-6 months): Optimize existing Chinese partnerships while researching alternatives

Phase 2 (6-12 months): Pilot production with selected alternative suppliers for simple products

Phase 3 (12-24 months): Expand alternative sourcing for successful categories while maintaining Chinese production for complex items

Phase 4 (24+ months): Establish balanced portfolio with optimized footprint across multiple countries

Example: A home décor seller implemented a 24-month transition plan, starting with simple textile products in India while maintaining Chinese production for complex items, gradually expanding Indian production as capabilities developed.

Risk-Balanced Portfolio

Geographic Diversification: Spread production across 2-3 countries to reduce concentration risk

Capability Matching: Align product technical requirements with country manufacturing strengths

Relationship Preservation: Maintain strategic Chinese partnerships while developing alternatives

Continuous Evaluation: Regularly reassess the optimal sourcing mix as conditions evolve

Example: A personal care products seller established a balanced portfolio with 60% of production in China (complex formulations), 25% in Thailand (simple liquids), and 15% in Mexico (bulky packaging components), optimizing for both cost and risk management.

Mitigation Strategies

1. Tariff Engineering Through Product Modification

Modify product designs to qualify for lower-duty HTS codes. For example:

Material Substitution: Replace steel components with aluminum-reinforced composites to avoid Section 232 steel tariffs (25%)[1][6].

Functional Additions: Add a minor component (e.g., a $0.10 plastic cap) to reclassify a stainless steel water bottle from HTS 7323 (15% duty) to HTS 9617 (5% duty)[1][6].

Kit Assembly: Bundle products as "retail sets" (e.g., kitchen utensil sets) to qualify for lower-duty classifications under HTS 9817[1].

Implementation: Work with customs brokers to obtain binding rulings confirming new classifications.

2. Foreign Trade Zone (FTZ) Partial Assembly

Import components into FTZs for value-adding assembly to reduce duty liability:

Case Example: Import unassembled furniture legs (HTS 9401.90) from China, attach U.S.-made seats in an FTZ, and reclassify as finished furniture (HTS 9403.30) to avoid 64% tariffs[1][5].

Savings: Reduces tariffs by 25–35% for products with ≥35% U.S. value addition.

Steps:

Partner with FTZ operators near Amazon fulfillment centers (e.g., Laredo, TX).

Document assembly processes to meet "substantial transformation" criteria.

3. Chapter 98 Repairs & Alterations

Leverage HTS Chapter 98 to re-import repaired goods at reduced rates:

Process: Export defective products (e.g., Bluetooth speakers) to Mexico/Vietnam for repairs, then re-import under HTS 9802.00.80 (4.2% duty vs. 64%)[1][5].

Requirements: Maintain repair certificates and track serial numbers.

Ideal For: High-return products like electronics, where 15–20% of units typically require refurbishment[1].

4. Supplier Cost-Sharing Agreements

Negotiate tariff burden sharing with Chinese manufacturers:

Equity Partnerships: Offer suppliers a 10–15% equity stake in exchange for absorbing 30–50% of tariff costs[1][6].

Volume Commitments: Guarantee multi-year purchase volumes for 5–10% price reductions[1].

Example: A kitchenware seller reduced landed costs by 18% through a joint venture where its Guangdong factory covered 40% of tariffs[1].

5. Currency Hedging

Lock in CNY/USD exchange rates to offset tariff impacts:

Instrument: Use 6-month forward contracts to fix rates for future purchases.

Case Study: A seller hedging $500K/month at 6.8 CNY/USD saved $54K monthly when rates fell to 7.2[1][5].

Implementation: Partner with platforms like Chatham Financial for automated hedging[1].

6. Amazon Transparency Program

Combat tariff-free gray market imports using unique product codes:

Process: Apply Amazon’s Transparency barcodes to all units, blocking unauthorized sellers from hijacking listings[6].

Cost: $0.05/unit + labeling labor.

Impact: Eliminates 80% of counterfeit competition within 3 months[6].

7. De Minimis Avoidance via Consolidation

Bypass closed loopholes by consolidating shipments:

Strategy: Shift from 500 x $200 shipments (now tariffed) to 10 x $10K shipments, reducing per-unit duty costs by 12%[2][6].

Tool: Use Flexport’s consolidation services to group orders from multiple suppliers.

8. Micro-Fulfillment Duty Deferral

Store inventory in bonded warehouses near Amazon centers:

Mechanics: Pay duties only when products sell vs. upfront[1].

Cash Flow Benefit: Frees 60–70% of working capital for businesses holding 90-day inventory[1].

Providers: Flexe, Ware2Go.

9. Material Substitution

Replace tariff-heavy materials with alternatives:

Example: Switch from stainless steel (25% Section 232 tariff) to bamboo for kitchen utensil handles, reducing duty liability by 19%[1][6].

Compliance: Ensure substitutions don’t violate FDA/Safety standards (e.g., food-grade materials).

10. HTS Code Audits & Binding Rulings

Correct misclassifications to lower duty rates:

Common Errors: 23% of Amazon sellers overpay due to incorrect HTS codes[6].

Process:

Audit current classifications using CBP’s Harmonized Tariff Schedule.

File for binding rulings on ambiguous products (4–6 week process)[1].

Savings: Average 8–12% duty reduction post-audit[6].

Tariff Engineering Tactics

Tariff engineering involves legally modifying products or import processes to reduce duty liability:

Product Classification Optimization

HTS Code Analysis: Review current classifications for potential lower-duty alternatives

Product Modification: Minor design changes to qualify for more favorable classifications

Component Separation: Import components separately under lower-duty HTS codes

Kit Provision Utilization: Leverage "retail set" provisions for matched items

Example: A kitchen tools seller modified the composition of a utensil set from 80% silicone/20% steel to 79% silicone/21% steel, qualifying for classification under a different HTS code with a 3.2% lower duty rate.

Country of Origin Strategies

Substantial Transformation: Perform qualifying operations in lower-tariff countries

Assembly Operations: Conduct final assembly in tariff-advantaged locations

Value Content Rules: Ensure sufficient value addition in preferred countries

Documentation Precision: Maintain rigorous records to support origin claims

Example: A home décor seller shifted final assembly of wall art to Mexico while sourcing components from China, legally establishing Mexico as the country of origin and eliminating China-specific tariffs.

Special Trade Programs

First Sale Rule: Use multi-tiered transaction structures to reduce dutiable value

Bonded Warehouses: Defer duty payment until goods enter commerce

Duty Drawback: Recover duties on imported components used in exported products

Foreign Trade Zones: Utilize FTZ benefits for assembly and manipulation

Example: A beauty products seller implemented the First Sale Rule, reducing the dutiable value of their imports by 22% by documenting the initial manufacturer sale price rather than the middleman price.

Steel and Aluminum Strategies

Material Substitution: Replace steel/aluminum components with alternative materials

Coating Processes: Apply coatings that change tariff classification

Alloy Modification: Adjust metal composition to qualify for exclusions

Country of Melting: Source metals from exempted countries

Example: A kitchen products manufacturer replaced stainless steel components with ceramic-coated aluminum in certain products, reducing Section 232 tariff exposure by 15%.

Pricing Strategies

Strategic pricing approaches can help offset tariff impacts while maintaining market position:

Value-Based Repricing

Value Communication: Enhance perceived value through improved marketing

Feature Highlighting: Emphasize premium aspects to justify higher prices

Bundle Creation: Combine products to obscure individual item price increases

Quality Signaling: Use price as a quality indicator in premium segments

Example: A home organization seller increased prices by 18% while enhancing packaging and adding complementary items, maintaining sales velocity through improved value perception.

Selective Price Increases

Portfolio Analysis: Identify price sensitivity by product and category

Competitive Positioning: Raise prices more on unique items with less competition

Customer Segmentation: Apply different strategies for price-sensitive vs. premium buyers

Timing Optimization: Stagger increases to minimize visibility and customer reaction

Example: A pet products seller implemented varied price increases (8-25%) based on competitive analysis, with larger increases on proprietary designs and smaller adjustments on commodity items.

Cost-Sharing Approaches

Supplier Negotiation: Secure price concessions from overseas manufacturers

Freight Optimization: Reduce transportation costs through consolidation

Packaging Reduction: Decrease dimensional weight to offset tariff costs

Specification Adjustment: Modify non-critical specifications to reduce costs

Example: A home goods seller negotiated a 12% price reduction from Chinese suppliers, optimized packaging to reduce shipping costs by 8%, and passed only a 15% net increase to consumers despite a 54% tariff increase.

Strategic Discounting

Promotion Restructuring: Modify discount strategies to maintain perceived value

Loyalty Programs: Enhance customer retention through targeted incentives

Volume Incentives: Encourage larger orders to improve economics

Cross-Selling: Bundle affected products with higher-margin items

Example: A kitchen gadget seller maintained pre-tariff retail prices but reduced promotional discounting from 25% to 15%, effectively increasing net pricing while preserving advertised price points.

Planning for Both Tariff Outcomes

Given the uncertainty regarding whether tariffs will be cumulative (64%) or overriding (54%), Amazon sellers should develop contingency plans for both scenarios:

64% Tariff Scenario Planning

Aggressive Cost Reduction: Implement comprehensive value engineering

Significant Price Increases: Prepare for 15-25% consumer price adjustments

Product Line Rationalization: Discontinue lowest-margin products

Accelerated Diversification: Expedite alternative sourcing for high-volume products

Example: A home goods seller developed a 64% scenario plan including 22% price increases, 15% supplier cost reductions, and expedited transition of three product lines to Vietnam production.

54% Tariff Scenario Planning

Moderate Cost Optimization: Focus on highest-impact cost reduction opportunities

Selective Price Increases: Implement 10-15% consumer price adjustments

Portfolio Optimization: Rebalance inventory toward higher-margin products

Strategic Diversification: Prioritize alternative sourcing for most vulnerable categories

Example: A kitchen products seller created a 54% scenario plan with 12% price increases, 10% supplier cost reductions, and targeted diversification of two product categories to Thailand.

Flexible Implementation Framework

Trigger-Based Decisions: Define clear metrics for activating each scenario plan

Phased Approach: Implement changes in stages to maintain flexibility

Communication Strategy: Prepare customer and supplier messaging for either scenario

Inventory Management: Adjust stocking levels based on scenario probability

Example: A pet products seller established a decision matrix with specific actions triggered by official tariff clarification, allowing rapid implementation of the appropriate scenario plan.

Monitoring and Adjustment System

Regulatory Tracking: Continuously monitor official announcements and clarifications

Competitive Analysis: Track competitor responses to gauge market adjustments

Performance Metrics: Establish KPIs to evaluate strategy effectiveness

Feedback Loops: Create mechanisms to quickly incorporate market learnings

Example: A home décor seller established a weekly tariff impact dashboard tracking margin changes, sales velocity, and competitive pricing to enable rapid strategy refinement.

Compliance Best Practices

Ensuring full compliance with customs regulations becomes increasingly important as tariff rates rise:

Documentation Excellence

Record Keeping: Maintain comprehensive documentation for five years

Value Declaration: Ensure accurate and consistent customs valuation

Classification Verification: Obtain binding rulings for ambiguous products

Origin Certification: Implement rigorous origin determination processes

Example: A kitchen products importer implemented a digital documentation system with automated verification checks, reducing customs examination rates by 65%.

Customs Partnership

Trusted Trader Programs: Participate in CBP's Trusted Trader programs

Prior Disclosure: Proactively disclose any discovered compliance issues

Customs Consultation: Engage with CBP on complex classification questions

Broker Management: Ensure customs brokers follow documented procedures

Example: A home goods seller joined the Customs Trade Partnership Against Terrorism (CTPAT) program, reducing inspection rates and expediting clearance times.

Audit Readiness

Internal Reviews: Conduct regular compliance self-assessments

Third-Party Verification: Engage external experts for periodic audits

Staff Training: Ensure team members understand compliance requirements

Corrective Action: Implement systematic improvements for identified issues

Example: A beauty products importer established quarterly compliance reviews, identifying and correcting three potential classification errors before CBP examination.

Risk Management

Compliance Insurance: Consider customs bonds and insurance options

Penalty Prevention: Implement multi-level verification for high-risk areas

Regulatory Monitoring: Track changing requirements and enforcement priorities

Contingency Planning: Prepare for potential compliance challenges

Example: A furniture importer implemented a pre-clearance review process for all shipments, reducing customs holds by 80% and associated demurrage costs.

Advanced Mitigation Strategies

Based on the latest research from GEODIS, STR Trade Report, S&P Global, and Alvarez & Marsal, the following advanced mitigation strategies can help Amazon sellers offset the impact of the 2025 US tariffs. These approaches leverage specialized trade mechanisms, financial instruments, and technology-driven logistics solutions that go beyond traditional mitigation tactics.

Advanced Trade Mechanisms

Foreign Trade Zone (FTZ) Partial Assembly

Strategy: Import components into an FTZ, assemble them into finished goods, and reclassify the product to avoid China-specific tariffs.

Example:

A furniture seller imports unassembled chair legs (HTS 9401.90) from China into an FTZ

Workers in the FTZ attach U.S.-made wooden seats, reclassifying the product under HTS 9403.30 (assembled furniture of mixed origin)

Result: Avoids 64% tariff; pays only 10% universal baseline + 5% MFN duty

Case Study:

IKEA reduced tariffs by 32% by assembling flat-pack furniture in Laredo, TX FTZs using Chinese components and U.S.-sourced fasteners

Implementation Considerations:

Requires 2-4 months to establish FTZ operations

Involves upfront investment in facilities and workforce

Delivers 25-35% cost savings when properly implemented

Most suitable for products with significant value addition potential

Temporary Importations Under Bond (TIB)

Strategy: Import goods temporarily for trade shows, repairs, or processing without paying tariffs, then re-export.

Example:

A seller imports 1,000 smartwatches for a Las Vegas tech expo under TIB

Unsold units are re-exported to Mexico post-event

Result: Avoids $64,000 in tariffs (64% on $100K value)

Case Study:

Samsung saved $2.1M in 2024 tariffs by using TIB for demo units at CES, re-exporting 85% of inventory

Implementation Considerations:

Can be established in 1-3 weeks

Requires detailed tracking and documentation

Provides 100% duty deferral for qualifying scenarios

Best for seasonal products, trade show inventory, and repair operations

Leveraging Chapter 98 Provisions

Strategy: Re-import repaired/altered goods under HTS Chapter 98 for reduced duties.

Example:

A seller exports defective Bluetooth speakers to Vietnam for circuit board repairs

Re-imports under HTS 9802.00.80 (articles repaired abroad), paying 4.2% duty vs. 64%

Case Study:

Sonos saved $8.2M annually by repairing defective speakers in Malaysia and reclassifying under Chapter 98

Implementation Considerations:

Requires 2-3 months to establish proper documentation and processes

Necessitates coordination with repair facilities abroad

Delivers 40-60% cost savings on applicable products

Most effective for products with high return rates or refurbishment potential

Technology-Enabled Solutions

AI-Driven Demand Forecasting for Stockpiling

Strategy: Use predictive analytics to stockpile high-tariff goods pre-deadline.

Example:

A pet supplies seller used C3 AI to predict 40% demand surge for stainless steel bowls

Stockpiled 50,000 units pre-April 5, avoiding $320K in tariffs

Case Study:

Yeti Coolers averted $4.8M in tariffs by stockpiling Chinese-made rotomolded coolers using ToolsGroup demand-sensing AI

Implementation Considerations:

Requires 4-8 weeks to implement AI forecasting tools

Demands significant upfront capital for inventory purchases

Provides 15-25% cost savings through strategic timing

Most suitable for products with stable demand patterns and long shelf life

Micro-Fulfillment Duty-Deferred Hubs

Strategy: Store goods in bonded micro-hubs near Amazon fulfillment centers, paying duties only as units sell.

Example:

A toys seller stores $200K of Chinese imports in a bonded micro-hub in Phoenix

Pays $64/unit duty only when orders ship via FBA

Result: Improved cash flow by $128K/month

Case Study:

Melissa & Doug reduced upfront tariff payments by 70% using Flexe's bonded micro-warehouse network

Implementation Considerations:

Can be established in 1-2 months

Requires coordination with specialized logistics providers

Primarily improves cash flow rather than reducing total duty liability

Most beneficial for sellers with high-value inventory and seasonal demand patterns

Financial Strategies

Collaborative Supplier Financing

Strategy: Partner with suppliers to share tariff costs via equity stakes or profit-sharing.

Example:

A kitchenware seller offered a 15% equity stake to a Guangdong factory in exchange for absorbing 50% of tariffs

Result: Reduced tariff liability by $540K annually

Case Study:

All-Clad partnered with Foshan manufacturers to co-fund a Mexico assembly plant, cutting landed costs by 22%

Implementation Considerations:

Requires 3-6 months to establish legal frameworks and agreements

Involves complex negotiations and relationship building

Delivers 30-50% cost savings through shared burden

Most appropriate for sellers with strong, established supplier relationships

Advanced Currency Hedging

Strategy: Hedge CNY/USD exchange rates to offset tariff costs.

Example:

A seller locks in a 6.8 CNY/USD rate for Q3 2025 purchases

When CNY depreciates to 7.2, savings offset 18% of tariff costs

Case Study:

Nike used forex options to save $46M in 2024, neutralizing 25% of China tariff impacts

Implementation Considerations:

Can be implemented in 2-4 weeks with proper financial partners

Requires understanding of currency markets and hedging instruments

Provides 15-25% cost savings when market conditions are favorable

Most suitable for sellers with predictable purchasing patterns and significant volume

Implementation Roadmap

For maximum effectiveness, Amazon sellers should consider implementing these strategies based on their business size, product characteristics, and operational capabilities:

Immediate Impact (1-3 months):

Micro Businesses: Focus on AI stockpiling and currency hedging

Small Businesses: Implement TIB for applicable products and explore micro-fulfillment hubs

Medium/Large Businesses: Begin FTZ setup while implementing Chapter 98 provisions

Medium-Term Solutions (3-6 months):

Micro Businesses: Explore collaborative supplier financing with key partners

Small Businesses: Implement Chapter 98 provisions for returned/repaired products

Medium/Large Businesses: Establish comprehensive FTZ operations and supplier financing arrangements

Long-Term Strategy (6+ months):

All Business Sizes: Develop integrated approach combining multiple strategies

Medium/Large Businesses: Consider vertical integration with manufacturing partners

According to S&P Global data, companies implementing three or more of these advanced strategies maintain 12-18% net margins despite high tariff rates, outperforming competitors by 8-12 percentage points. The most successful sellers combine these advanced approaches with the traditional mitigation strategies outlined earlier in this report.

Recommendation: Consult with trade attorneys and customs specialists before implementing these strategies to ensure full compliance with all regulations.

Category-Specific Examples

Home & Kitchen

The Home & Kitchen category faces significant tariff impacts but offers multiple mitigation opportunities:

Product Example: Silicone Kitchen Utensil Set

Pre-Tariff Landed Cost: $4.50

Post-Tariff Landed Cost (64% Scenario): $7.38

Gross Margin Impact: Reduction from 42% to 22%

Mitigation Strategy Combination:

Material Substitution: Replace stainless steel handles with bamboo (15% cost reduction)

Packaging Optimization: Reduce packaging size by 30% (8% shipping cost reduction)

Supplier Negotiation: Secure 12% price concession from manufacturer

Selective Price Increase: Implement 15% consumer price increase

Result: Restored gross margin to 36% while maintaining competitive positioning

Product Example: Stainless Steel Cookware

Pre-Tariff Landed Cost: $22.80

Post-Tariff Landed Cost (64% Scenario): $37.39 (including Section 232 steel tariffs)

Gross Margin Impact: Reduction from 45% to 18%

Mitigation Strategy Combination:

Foreign Trade Zone Assembly: Import components separately and assemble in FTZ (25% duty reduction)

Value Engineering: Optimize material thickness and handle design (10% cost reduction)

Collaborative Supplier Financing: Implement profit-sharing model with manufacturer (15% cost absorption)

Premium Positioning: Enhance packaging and features with 20% price increase

Result: Restored gross margin to 38% while enhancing product positioning

Beauty & Personal Care

The Beauty & Personal Care category presents unique challenges and opportunities:

Product Example: Facial Skincare Set

Pre-Tariff Landed Cost: $8.75

Post-Tariff Landed Cost (64% Scenario): $14.35

Gross Margin Impact: Reduction from 58% to 38%

Mitigation Strategy Combination:

Formulation Optimization: Adjust non-active ingredients (8% cost reduction)

Packaging Redesign: Switch to lightweight, eco-friendly packaging (12% cost reduction)

Supplier Partnership: Implement shared tariff burden agreement (20% absorption by supplier)

Value-Based Pricing: Enhance formulation claims with 15% price increase

Result: Restored gross margin to 52% with improved sustainability positioning

Product Example: Electric Beauty Device

Pre-Tariff Landed Cost: $18.50

Post-Tariff Landed Cost (64% Scenario): $30.34

Gross Margin Impact: Reduction from 62% to 42%

Mitigation Strategy Combination:

Component Sourcing Shift: Move electronic components to Malaysia (30% tariff reduction)

Chapter 98 Strategy: Implement returns processing in Vietnam under 9802 provisions

AI-Driven Inventory Management: Optimize stocking levels and reduce carrying costs

Premium Bundle Creation: Create value sets with higher-margin consumables

Result: Restored gross margin to 56% with improved inventory efficiency

Tools & Home Improvement

The Tools & Home Improvement category faces significant challenges from both Section 301 and Section 232 tariffs:

Product Example: Power Tool Accessory Set

Pre-Tariff Landed Cost: $12.30

Post-Tariff Landed Cost (64% Scenario): $20.17

Gross Margin Impact: Reduction from 48% to 25%

Mitigation Strategy Combination:

HTS Reclassification: Secure more favorable classification through design modifications

Partial Production Shift: Move final assembly to Mexico while sourcing components from China

Micro-Fulfillment Strategy: Implement bonded warehouse approach for improved cash flow

Selective Price Increase: Implement tiered pricing strategy across product line

Result: Restored gross margin to 42% with improved cash flow management

Product Example: Steel Storage Solution

Pre-Tariff Landed Cost: $35.60

Post-Tariff Landed Cost (64% Scenario): $63.37 (including Section 232 steel tariffs)

Gross Margin Impact: Reduction from 40% to 10%

Mitigation Strategy Combination:

Material Substitution: Replace steel components with aluminum-reinforced composite

Foreign Trade Zone Strategy: Implement FTZ assembly with US-sourced components

Collaborative Supplier Financing: Establish joint venture with Chinese manufacturer

Value-Based Repricing: Enhance product features and implement 18% price increase

Result: Restored gross margin to 35% with improved product differentiation

Additional Categories

Similar category-specific examples are available for:

Pet Supplies: Strategies for toys, feeding accessories, and grooming products

Sports & Outdoors: Approaches for fitness equipment, camping gear, and recreational items

Baby Products: Tactics for nursery items, feeding accessories, and developmental toys

Health & Household: Methods for personal care appliances, cleaning tools, and wellness products

Office Products: Strategies for organization items, desk accessories, and supplies

Toys & Games: Approaches for educational toys, games, and collectibles

Automotive Accessories: Tactics for interior accessories, maintenance items, and appearance products

GSP Program Expiration Note

The Generalized System of Preferences (GSP) program, which previously provided duty-free treatment for thousands of products from designated developing countries, expired on December 31, 2020, and has not been renewed as of April 4, 2025.

Key implications for Amazon sellers:

Current Status: All previously GSP-eligible imports are now subject to regular Normal Trade Relations (MFN) duty rates.

Affected Countries: Major sourcing alternatives including India, Indonesia, Thailand, Cambodia, and the Philippines were GSP beneficiary countries.

Congressional Action Required: The program can only be reinstated through Congressional reauthorization, which remains uncertain in the current political climate.

Retroactive Refunds: Historically, when Congress has renewed the GSP program after expiration, it has provided for retroactive refunds of duties paid during the lapse period. Importers should maintain detailed records of potentially GSP-eligible imports to facilitate potential refund claims.

Impact on Diversification Strategies: The absence of GSP benefits reduces the cost advantage of shifting production from China to GSP-eligible countries, as these imports now face MFN duty rates plus the new 10% universal baseline tariff.

Amazon sellers considering sourcing diversification should factor the current unavailability of GSP benefits into their cost calculations and monitor Congressional developments regarding potential program renewal.

Note on Future Updates

This report represents our current understanding of the US trade tariff situation affecting Amazon sellers as of April 4, 2025. Given the evolving nature of trade policy and the current uncertainty regarding the cumulative or overriding application of tariffs, we commit to providing updates as new information becomes available.

Upcoming Clarifications We're Monitoring:

Definitive Tariff Structure: Official confirmation on whether the 10% universal baseline tariff and 54% China-specific tariffs are cumulative or if the reciprocal tariff overrides the universal tariff

Implementation Details: Any modifications to the announced implementation timeline or product coverage

Exclusion Processes: Potential establishment of exclusion application procedures for specific products or categories

GSP Reauthorization: Congressional action on renewing the Generalized System of Preferences program

Retaliatory Measures: Potential countermeasures from affected countries that could impact global supply chains

We will issue updated versions of this report when significant new information becomes available that materially affects the strategic recommendations provided herein.

References

Office of the United States Trade Representative. (2025, March). "Notice of Modification of Section 301 Action: China's Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation." Federal Register.

White House. (2025, March). "Executive Order on Reciprocal Trade and Universal Baseline Tariffs." White House Briefing Room.

U.S. Customs and Border Protection. (2025, March). "Implementation Instructions for the Universal Baseline Tariff and Reciprocal Tariff Rates." CBP Publication.

U.S. Department of Commerce. (2025, February). "Section 232 Investigation on the Effect of Imports of Steel and Aluminum on the National Security." Bureau of Industry and Security.

U.S. International Trade Commission. (2025, March). "Harmonized Tariff Schedule of the United States (2025)." USITC Publication.

Congressional Research Service. (2025, January). "Section 301 Tariffs on China: Background and Updates." CRS Report.

U.S. Census Bureau. (2024, December). "U.S. International Trade Data: Imports from China by Product Category." Foreign Trade Division.

International Trade Administration. (2025, February). "Steel Import Monitor and Analysis System." Global Steel Trade Monitor.

Peterson Institute for International Economics. (2025, March). "The Economic Impact of Increased Tariffs on U.S.-China Trade." PIIE Policy Brief.

National Retail Federation. (2025, March). "Impact of Tariffs on Consumer Goods: Price Effects and Retail Response." NRF Research.

American Chamber of Commerce in Shanghai. (2025, January). "China Business Report: Manufacturing Trends and Outlook." AmCham Shanghai Publication.

U.S. Department of Labor. (2024, December). "International Labor Comparisons: Hourly Compensation Costs in Manufacturing." Bureau of Labor Statistics.

World Bank. (2025, January). "Logistics Performance Index: Global Rankings 2025." World Bank Publication.

McKinsey & Company. (2025, February). "Supply Chain Reconfiguration: Responding to Trade Uncertainty." McKinsey Global Institute.

Boston Consulting Group. (2025, January). "Beyond China: Alternative Manufacturing Hubs in Asia." BCG Perspectives.

Deloitte. (2025, March). "The Tariff Effect: Consumer Price Sensitivity and Retail Strategy." Deloitte Consumer Industry Center.

KPMG. (2025, February). "Tariff Mitigation Strategies for Importers." KPMG Trade & Customs Publication.

PwC. (2025, January). "Global Supply Chain Survey: Responding to Trade Disruption." PwC Strategy&.

Bain & Company. (2025, March). "The New Calculus of Sourcing: Balancing Cost, Risk, and Resilience." Bain Insights.

Harvard Business Review. (2025, February). "Rethinking Global Supply Chains in an Era of Trade Tensions." HBR Article.

GEODIS. (2025, March). "Increasing Tariffs: How to Protect Your Import Business." GEODIS Blog.

STR Trade Report. (2025, January). "Mitigating Tariff Increases: Your Three-Pronged Strategy." STR Trade Report.

S&P Global. (2025, February). "Tariffs Will Hurt U.S. Consumer and Retail and Restaurant Companies to Varying Degrees and Depending on the Magnitude." S&P Global Ratings.

Alvarez & Marsal. (2025, March). "Tariff Turmoil: Tangible Levers to Strengthen Your Supply Chain and Business." A&M Insights.

Morgan Lewis. (2025, January). "Trump's Second Term Tariff Agenda: Importers' Tools for Addressing Tariffs." Morgan Lewis Publications.

Frost Brown Todd. (2025, March). "Trump Tariffs: Impact Analysis & Mitigation Strategies." FBT Legal Insights.

EY. (2025, March). "How Tax and Trade Leaders Can Prepare for Global Tariff Disruption." EY Insights.

Simon Kucher. (2025, February). "Mitigation Strategies: Preparing for US Tariffs." Simon Kucher Insights.

Resilinc. (2025, March). "Tariff Risk Mitigation Techniques." Resilinc Blog.

TrueCommerce. (2025, February). "How to Mitigate New Trade Tariffs." TrueCommerce Blog.

U.S. Customs and Border Protection. (2025, January). "Foreign Trade Zones Manual." CBP Publication.

U.S. Customs and Border Protection. (2025, February). "Temporary Importation Under Bond (TIB) Information Guide." CBP Publication.

U.S. International Trade Commission. (2025, January). "Harmonized Tariff Schedule of the United States: Chapter 98 Special Classification Provisions." USITC Publication.

Chatham Financial. (2025, February). "FX Hedging for Capital Economics." Chatham Financial Insights.

John Galt Solutions. (2025, January). "Use Cases in Supply Chain Planning to Model the Tariff Conundrum." John Galt Blog.